Why we still believe in UK real estate after 30 years of investing

When Greenridge was founded in 1994, the real estate investment landscape looked very different from what it does today. For a start, there were fewer options available to investors by geography and sector, and information was less readily accessible.

Capital was less mobile, liquidity was intermittent, and there were fewer active institutions with the in-house infrastructure or resources at their disposal to build and dynamically scale international exposure to private markets.

Investors back then tended to favour ‘home-turf’ opportunities because of their familiarity – but also because of the opportunity cost of doing business elsewhere. In the UK in the late-nineties, anywhere between 60-70% of institutional commitments came from domestic pension funds and insurers, with minimal participation from cross-border sources of capital.

Steadily, this share of total capital flows has been flipped on its head, with capital providers in Europe, the US, Middle East and Asia seeking geographic diversification. For investment managers this has been a double-edged sword: One of broader liquidity, but also of less captive, more fluid capital that could easily move on to more attractive opportunities.

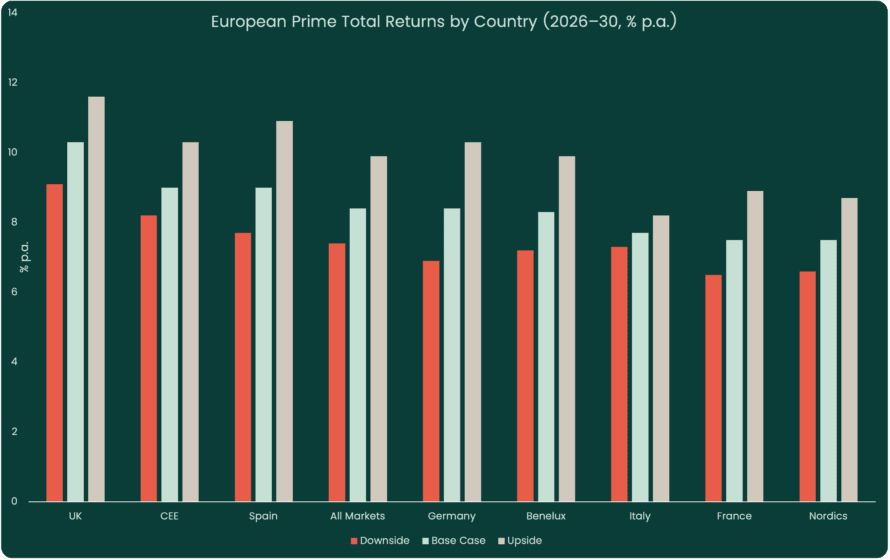

So, how does the UK remain compelling in this context? Is UK real estate compelling to investors today? We’ve heard defensive arguments that it is the security the UK provides on title and in respect of contract enforceability that keeps the UK in the spotlight. Transparency and legal certainty are important. But we should also present the active case for the UK in an era of more intense competition for capital.

As investors in UK real estate, we have – over the last three decades – seen a structural shift in the breadth of subsectors investors can now access. It wouldn’t be fair to describe the UK as a “proto-US” market, but there are similarities in how asset classes have evolved and the trajectory that institutional capital has taken.

Residential or ‘living’ has broadened into a greater opportunity set beyond open market sale, while offices did not exhibit the quality spread they do now. Private capital still has large gaps to fill in a market which is at a very different point of its evolution to maturer alternatives, such as the U.S.

Wider characteristics of the UK money market add to its appeal. From a capital markets perspective, for example, the UK has deeper channels into investors at all tiers and a more sophisticated infrastructure for clearing payments, securities and derivatives. That the UK has not defaulted on its sovereign debts since 1672 should provide further evidence of guarantee (the much-misunderstood 1976 IMF emergency loan being to bailout the Pound, not the government).

The UK’s financial sector is also culturally cross-border, with established primacy in sectors such as insurance and settlement. This difficult to replicate financial infrastructure reinforcing the view that UK assets offer some level of intrinsic downside protection by virtue of these qualities.

Despite Brexit, the integrity of the UK’s role as a hub for international capital has continued to strengthen, with impact on front-office roles relatively limited. Headlines about wealth outflows will – we believe – provide transient rather than structural and is reflected in the UK’s standing in high-growth, R&D-heavy sectors such as fintech and life sciences, with arbitrage opportunities present in the real estate these industries require to grow.

Outside of London, the UK is also relatively unexplored. In regional cities, where Greenridge has typically outperformed, a lack of market knowledge of granular demand-supply dynamics creates exploitable pockets of opportunity to secure high-quality stock at a material discount.

Focusing narrowly on the rigmarole of the UK’s politics misses the broader picture. International capital is more mobile than it has been before and may find that the direction that policy takes in other jurisdictions doesn’t always aid the case for investment. To say nothing of the fragmentation of capital markets by language and regulation that make continental Europe more challenging to access.

Of the options available; that combine liquidity with transparency and change in a market where institutional penetration in key sectors is still low versus the US, it stands that the UK should be an obvious and value accretive part of any well-diversified international real estate portfolio.