Why alignment of interests matters more than ever in an uncertain market

2026 is the year that many in the UK real estate industry are expecting the asset class to finally enter full recovery mode. Hopes for an upswing in 2025 were quickly dashed after tariffs and other geopolitical events rocked capital markets, with the mantra ‘survive ‘til ‘25’ quickly becoming ‘survive through ‘25’.

Roll on to January, and we are beginning to see green shoots as confidence improves, though where we should anticipate action is likely to be uneven across sectors and geographies. As Savills Head of UK Commercial Real Estate research recently told Greenridge partners Paul Simmons and Alex Walker: ‘downturns in property are always relatively synchronous, upturns tend to be relatively asynchronous’.

Breaking down by sector, the root causes of this asychronocity are easy to see.

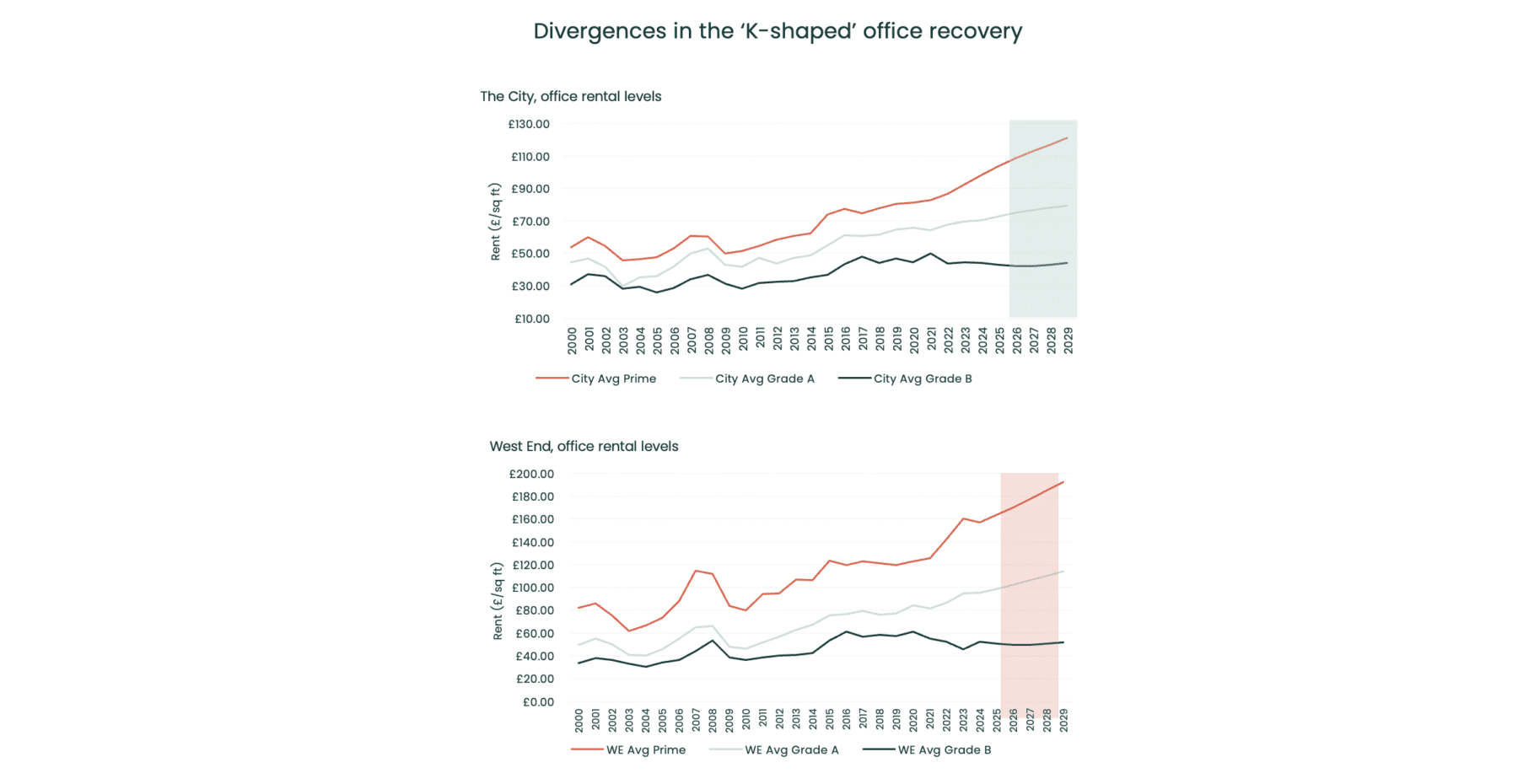

While sentiment towards offices remains mixed, occupational markets are proving resilient, with rental growth driven by a severe undersupply of high-quality space. Limited new development and upcoming regulatory changes, including EPC requirements, are further constraining available stock, supporting demand for well-positioned assets beyond the super-prime segment.

Retail, which had already experienced a structural repricing in the 2010s thanks to the rise of e-commerce, is looking appealing once again thanks to demonstrable rental growth, with institutional money re-entering select sub-sectors such as retail parks.

In the residential and living sectors, there is a compelling demand-supply story. Yet newer housing formats like co-living remain relatively unproven, while in established asset categories like student accommodation, enrolment trends and the favourable forecasted growth of international competitive red brick ‘Russell Group’ universities are placing greater emphasis on regional provision cities such as Bristol, Birmingham, and Nottingham.

In industrial and logistics, there remains a strong story in the near- and re-shoring of manufacturing but as rising vacancy levels have demonstrated, from an occupational perspective, sheds are just as vulnerable to demand destruction as shops or offices.

At Greenridge, we see this asychronocity in the UK as an opportunity. With a flexible investment mandate, unconstrained by sector or geography, we can pivot to where we see the most compelling opportunity.

From our 30+ years of investing in UK real estate, we know recoveries tend to follow a familiar pattern. London, thanks to its deeper and more liquid capital markets, will lead the pack, followed by core regional cities. Large institutional investors will be some of the last to re-enter, being fearful of a catching knife, while family offices and smaller PE funds will lead the initial charge. Where this recovery does differ is the relative lack of distress to date, with post-GFC reforms enabling banks to ‘extend and refinance’ challenged assets. However, this dynamic is unlikely to persist indefinitely. As loan maturities approach, particularly for financing agreed prior to the Truss-era repricing of debt, refinancing risk is expected to increase, bringing a degree of forced selling back into the market.

While the recovery phase of the real estate cycle undoubtedly creates openings for outsized returns, discipline and caution must be exercised, and there is no more motivating factor than having skin in the game for each transaction.

While we may be excited about opportunities in London, which we see as offering excellent value for the first time in a long time, or in select sub-markets within regional cities, we know one misstep and bad investment can derail a strategy and erode trust.

First established in 1994 as a private property company, Greenridge expanded over a decade ago to manage third-party capital. We now serve a global client base comprising institutional and private investors. Yet we have still retained a proprietary mindset, committing significant co-investment from our own balance sheet to each and every transaction, and only pursuing acquisitions we would be comfortable fully owning outright ourselves.

We often tell our investment partners we have an emotional attachment to our capital, treating each transaction as if it was our first ever. The material attachment, knowing your balance sheet suffers or gains, is clearly important too.

Alignment of interest is just as important for securing an exit as it is for the entry. Too many managers, motivated by carry, hold onto assets for too long in the pursuit of extra gains, only to then see the market turn against them. Having a meaningful stake that you know can recycle that capital into new opportunities keeps you focussed – and is how we’ve managed to scale over the decades.