FAQ: UK Real Estate: why here, and why now?

Though growth has softened post-GFC in lock-step with other countries in Western Europe, the UK remains one of the largest, most sophisticated, and most productively diversified economies in the world with a leading position in finance and professional services, R&D, advanced engineering, science and technology sectors.

In addition to its stable capital markets and regulatory complexity, the UK benefits from ‘soft power’ in the form of English’s place as the language of business and long-established rule of law that is foundational to the judicial regimes of over 80 other countries. Other factors, like the global reach of the UK’s public and higher education; the UK’s role in cutting-edge innovation, and its de facto standing as an arbiter to international trade negotiations, pass through into the popularity of UK publicly listed and private enterprise, UK real estate, and contribute to the depth of its investible opportunities.

In contrast to social media narratives which vastly overstate the level of violent or personal crime, the UK is becoming comparatively safer than equivalent countries. As of 2025, burglary and knife-related incidents are at 30-year lows, with this domestic context complementing the security offered by UK jurisprudence.

Why invest in UK real estate?

Beyond the core reasons to invest in real estate, lower correlation to public markets, its defensive investment profile, inflation-hedging qualities; tangibility, and ability to easily influence positive environmental and social outcomes, UK real estate offers security, predictability and transparency that other regions can’t deliver to the same standard.

This context is reflected in strong protection for property and title rights, and contract enforcement, with clear protocol for sponsors. The UK ranks first globally for real estate transparency, which gives investors confidence that pricing is based on free market dynamics, and is underpinned by clear regulation, valuation consistency and open data.

Today, this transparency is central to attracting the liquidity needed to achieve the timely rebasing of values after a period of correction, creating an opportunity – now materialising – for early-cycle investors to capitalise on price dislocation. This is in addition to the scale and maturity of the UK market, with institutional capital ‘sitting out the cycle’ readily replaced by family offices and private wealth investors that drive transaction volumes higher up the risk curve and, in many cases, shape the typical lot size of investments in periods of pricing opacity.

Overall, the UK commercial real estate market is valued at USD 148.8 billion as of 2025 and according to Savills, investment volumes reached their second-highest level in over three years in Q2 2025, with total office and industrial volumes expected to exceed 2024 levels. For these reasons, we see right now as offering a compelling buying opportunity; a moment in the cycle when credit pressures and the final stages of the ‘blend and extend’ phase offer up a ‘golden window’ to acquire fundamentally sound assets at an attractive entry point in the cycle.

With income levels having remained healthy even as capital values reset, early movers have the ability to benefit from continued dividend yield through the cycle as values recover, supported by easing monetary policy.

Where to invest?

London is a magnet for international capital, supported by its global connectivity and the diversity of its economy. The London Stock Exchange is the most international exchange in the world, with significant advantages derived from its geographical position and time zone.

From a real estate perspective, however, the recent market correction now means for the first time in a while London represents relative value. We also see considerable opportunity in core regional cities such as Birmingham, Bristol, Leeds and Manchester, where reduced competition and information asymmetry enable experienced, well-networked investors to access attractive opportunities.

These regions represent opportunities to invest in high-quality assets trading at mispriced valuation, in what we expect to be a particularly attractive window for disciplined investors to buy into cost-efficient income alongside gradual capital appreciation.

Of course, while broad-based, this recovery will have its ‘winners’ and for this reason we have preferred sectors. With decades of relationship-building providing privileged access to off-market opportunities, it is in these sectors where we have deep knowledge, and have seen similar dislocations, that we continue to acquire high-quality assets with the ability to tactically play shorter-term cycles where the pay-off is compelling.

What about taxation and policy risk?

UK property tax changes continue to predominantly target the prime London residential market and buy-to-let investors. In the case of the latter, this creates an opening for sophisticated capital to enter the residential-for-rent market, which has compelling demand-supply dynamics thanks to years of under-supply and over encumbered amateur landlords exiting the sector.

Importantly, from a fund perspective and alongside other well established tax efficient structures, recent regulatory developments have further expanded the range of tax-efficient vehicles available to professional investors. The Long-Term Asset Fund (LTAF) and the new Reserved Investor Fund (RIF) structures are designed to facilitate investment in illiquid assets such as real estate, while offering appropriate structural safeguards.

When compared to several EU jurisdictions, the UK’s overall tax burden on real estate transactions remains competitive. For example, France levies effective acquisition costs often exceeding 7%, versus an average of 6.5% in the UK. And despite concerns that the latest Budget prepares the UK for fiscal tightening, there are credible views that the backloaded nature of these anticipated tax rises means many suggested changes to personal taxation will not materialise in their current form.

Is the UK economy really underperforming?

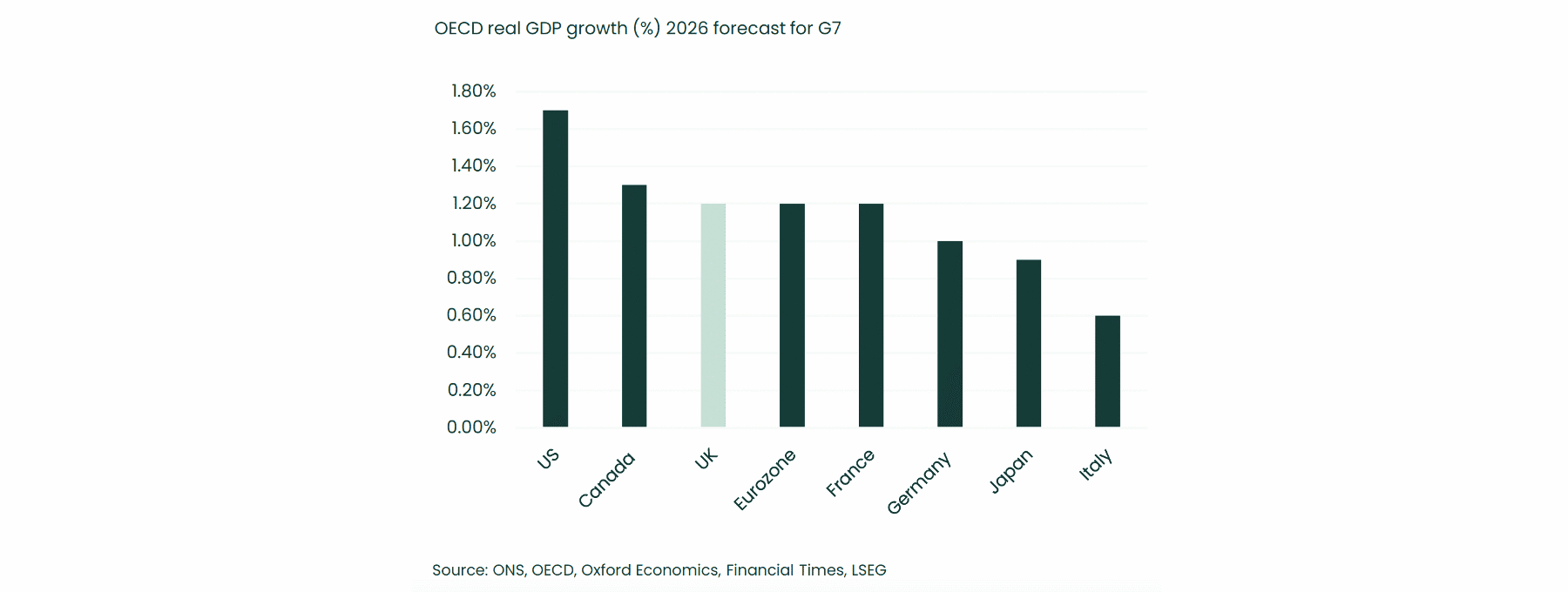

While macroeconomic challenges persist, the narrative of a ‘limping’ UK economy is overstated. The UK is expected to sit mid-table within the G7 economies, and outperform European peers at a national level, even if GDP per capita growth is set to underwhelm, which is in part down to large-scale migration (which creates a more favourable population pyramid) and under-investment into productivity capacity, which the current government has recognised as a serious issue. The UK government’s embrace of the Fingleton Review of nuclear energy and signal it may apply recommendations to other sectors such as transport and infrastructure are a positive sign.

While UK inflation has proved stickier than in the Eurozone, the Bank of England expects CPI to reach its 2% target by 2027, which has positive implications for the cost of capital and benchmark risk-free rate .

The UK also offers a uniquely unified, flexible and transparent environment for investing in. The single jurisdiction structure reduces complexity and enhances speed and certainty of execution, differing from our peers on our doorstep in Europe, which is multi-jurisdictional, multi-language and subject to divergent regulatory and tax regimes in contrast.

The US, while higher growth than the UK & Europe, has a heightened level of policy risk following the election of President Trump (see the stop-work orders on renewable energy projects) as well as divergent regulatory and tax regimes owing to the federal state system.

Is there an oversupply risk?

Far from it. The UK has faced a chronic undersupply of property for decades. Strict planning regulations, rising construction costs, and limited land availability have kept new supply well below demand. It reinforces the scarcity premium for existing high-quality assets, especially those with strong fundamentals and green credentials.

For example, housing completions remain well below the government’s target of 300,000 new homes per year, with restrictive planning frameworks and elevated construction costs constraining delivery.

The same pattern exists in commercial real estate. Despite recent reforms, development remains constrained by planning hurdles and sustainability requirements, which means modern, energy-efficient buildings compatible with tenant-driven requirements are in short supply. This dovetails with incoming EPC legislation, which will further restrict high-quality, energy-efficient stock.

Is social stability a concern for investors?

Media narratives often highlight issues of crime or civic disorder, but hard data paints a more nuanced picture. ONS figures show that overall crime rates have remained broadly stable over the last decade, and there is no evidence of systemic social instability that would materially impact property markets at scale. In fact, violent crime is at a 25-year low, and burglary has fallen two-thirds since the early 2000s. In October, London’s phone theft ‘near-epidemic’ reached a breakthrough, with the Metropolitan police dismantling a crime gang responsible for 40 per cent of phone thefts in London.

Unlike in some other developed economies, the UK’s working-age population is still expanding, supporting long-term demand for housing and commercial space. For investors, due diligence at the local level, assessing infrastructure, demographics, and occupational demand is still more important than looking at the UK through binoculars.

Why is now a good time to invest?

For long-term investors, the UK continues to present a compelling opportunity. Falling inflation and lower debt costs will support improved investment returns and promote increased real estate transactions.

Sharp repricing of commercial assets a few years ago saw values fall roughly 20% from all-time peaks, but last year, investment volumes were up 16% YoY, above global growth of 10 per cent. This repricing, alongside a focus on fundamentals, makes the current environment a window of opportunity rather than a warning signal.

Institutions in particular have been underweight real estate through the half-decade, due to strong equity performance. As heat leaves the ‘Mag 7’ and concerns about an ‘AI bubble’ in the mega-cap segment develops, we expect to see more dramatic price action and for the search for stability to take high-quality capital back into real estate, with this slow re-entry of competitive investment driving price recovery.

As many other managers work through impaired investments acquired at the top of the last cycle, we remain well-capitalised and agile, positioning us well to capitalise on mispricing and (dis)stressed scenarios.

Our value-first, fundamentals-led philosophy and bottom-up approach meant we maintained pricing discipline and protected our clients’ capital through the cycle’s trough, continuing to return capital to our investors and are now well-positioned to crystallise value regardless of market conditions.